Australian Dollar/U.S. Dollar(AUDUSD)FOREX

Australian Dollar Crawls Higher Against the U.S. Dollar in Early 2023

Australia is a unique nation because it is more than a country; it is a continent. The Commonwealth of Australia is a sovereign country comprising the mainland of the Australian continent, the island of Tasmania, and numerous smaller islands. It is the world’s sixth-largest country by area but is fifty-fifth in population, behind North Korea and ahead of Niger.

Meanwhile, Australia is a significant commodity-exporting country with a wealth of natural resources. The geographic location near Asia makes Australia a critical trading partner for China, the world’s most populous country with the second-leading economy. The Invesco Currency Shares Australian Dollar Trust (FXA) reflects the A$ versus the U.S. dollar foreign currency relationship.

Australia produces raw materials

The earth’s crust in Australia is rich in coal, iron ore, gold, lithium, uranium, and bauxite, the raw material required for aluminum production. Australia’s climate makes it a leading producer of sugar cane, barley, sorghum, oats, and wheat. Australia exports animal protein and wool and is a dairy and fruit producer, and beef and wheat are the top agricultural exports.

Australia’s location makes China the country’s leading export partner.

Australia’s economy relies on export and tourist revenues- Past commodity bull markets have supported the A$’s value

Australia is a beautiful country, making it a highly desirable tourist destination. Commodity production yields revenues and tax receipts, and the higher commodity prices rise, the more tax the government collects.

In 2011, the bull market in raw material markets took prices to multi-year or all-time highs, and it was no surprise that the Australian dollar versus the U.S. dollar moved to over parity.

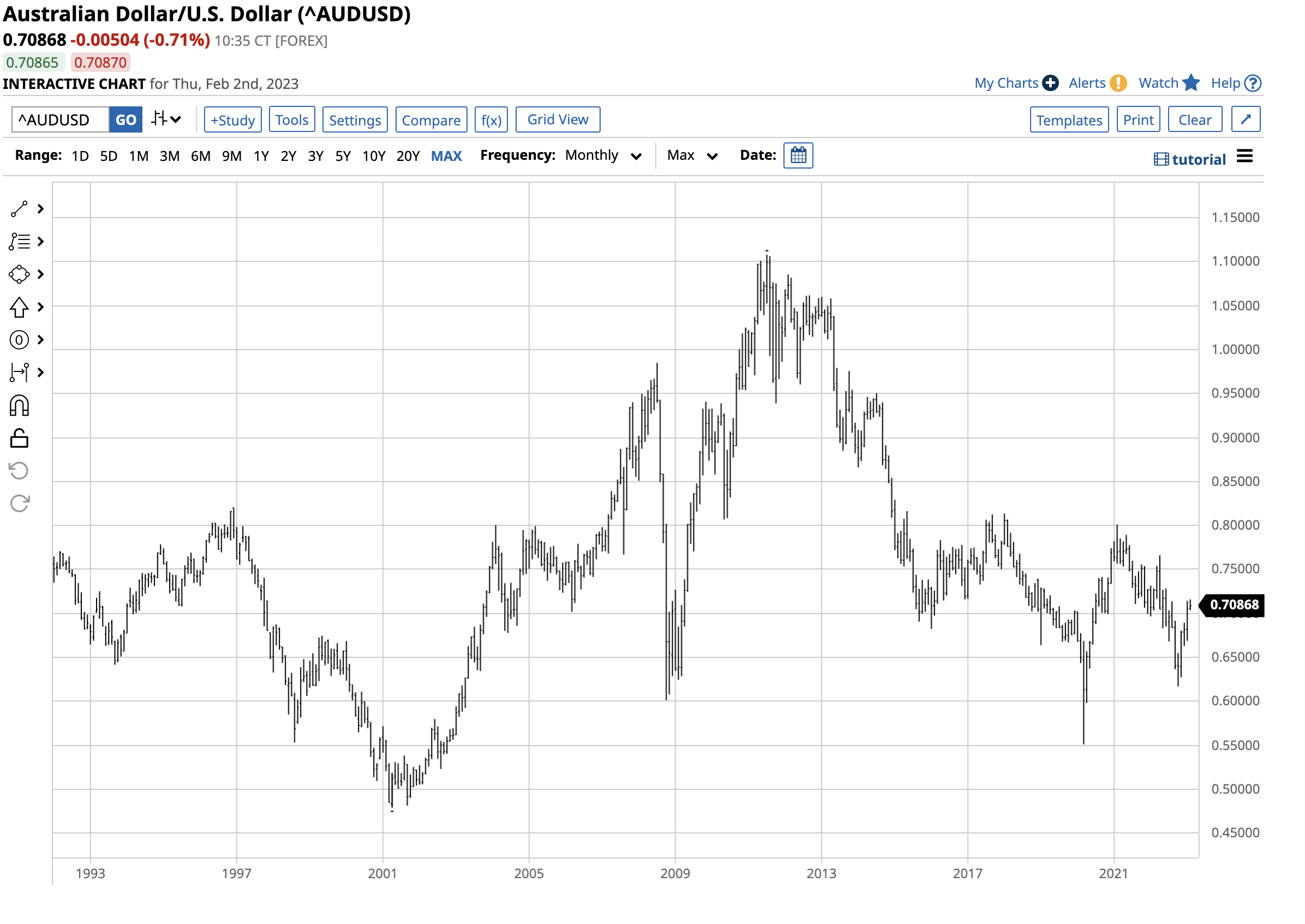

The long-term chart dating back to the early 1990s shows the A$ reached a high of $1.10787 against the U.S. dollar in July 2011, when many commodity prices peaked.

The Australian dollar fell during the pandemic

The chart also highlights the sharp decline to $0.55098 against the U.S. dollar in March 2020 as the global pandemic gripped markets across all asset classes. Many markets recovered from the March 2020. The tidal wave of central bank liquidity, a tsunami of government stimulus, and Russia’s invasion of Ukraine combined ignited an inflationary fuse and a bull market in commodities since the early 2020 lows. However, the A$’s rally against the U.S. currency did not rise to the levels seen in 2011 for four reasons:

- Chinese COVID-19 lockdowns have weighed on China’s economy, limiting commodity consumption and Australian exports to China.

- The Chinese government’s support for Russia and plans to reunify with Taiwan has caused relations between Australia and Beijing to deteriorate.

- The sharp rise in U.S. interest rates supported the U.S. dollar against all currencies, including the Australian dollar.

- COVID-19-related travel restrictions weighed on Australian tourist revenues.

While many commodities surpassed the 2011 peaks, these factors prevented the A$ from rising above the February 2021 $0.80069 peak, which stands as critical technical resistance in the A$ versus the U.S. $ currency relationship.

Higher lows against the U.S. dollar since October 2022- A bullish start to 2023

In October 2022, the A$ fell to $0.61703 against the U.S. dollar. Since then, the A$ has been steadily appreciating versus the world’s reserve currency.

The chart illustrates the rise from $0.61703 on October 13, 2022, to $0.71578 on February 2, 2023, a 16% rise. The currency relationship began making higher lows and higher highs in late October 2022, and the trend continued in early 2023.

FXA is the ETF that moves higher and lower with the A$ versus the U.S. dollar exchange rate

The most direct route for a risk position in the A$ versus the U.S. $ currency relationship is via the over-the-counter foreign exchange or futures markets. The Invesco Currency Shares Australian Dollar Trust (FXA) provides an alternative for market participants looking to add risk to portfolios via an instrument that trades on the stock market on the NYSE Arca.

At $70.22 on February 2, FXA had $84.042 million in assets under management. FXA trades an average of 10,415 shares daily and charges a 0.40% management fee. The currency relationship rose 16% since late October 2022 at the January 26 high.

Over the same period, FXA rose from $61.33 to $70.72 per share, or 15.3%. FXE does an excellent job tracking the A$ versus U.S. $ currency relationship, but it only trades during hours when the U.S. stock market operates. FXE does not reflect the highs or lows occurring during off-market hours.

As China emerges from COVID-19 protocols, the economy will likely recover, increasing the demand for Australian exports. Moreover, commodity prices remain at multi-year highs, supporting Australia’s currency, which is on a bullish path in early 2023.

More Forex News from Barchart

- Stocks Rally and Bond Yields Fall on Speculation Rate Hikes Nearing an End

- Dollar Tanks on Weak U.S. Economic Reports and Dovish Powell

- Stocks Moderately Lower on Mixed Economic News Ahead of FOMC

- Dollar Weakens Ahead of Wednesday’s FOMC Results

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.